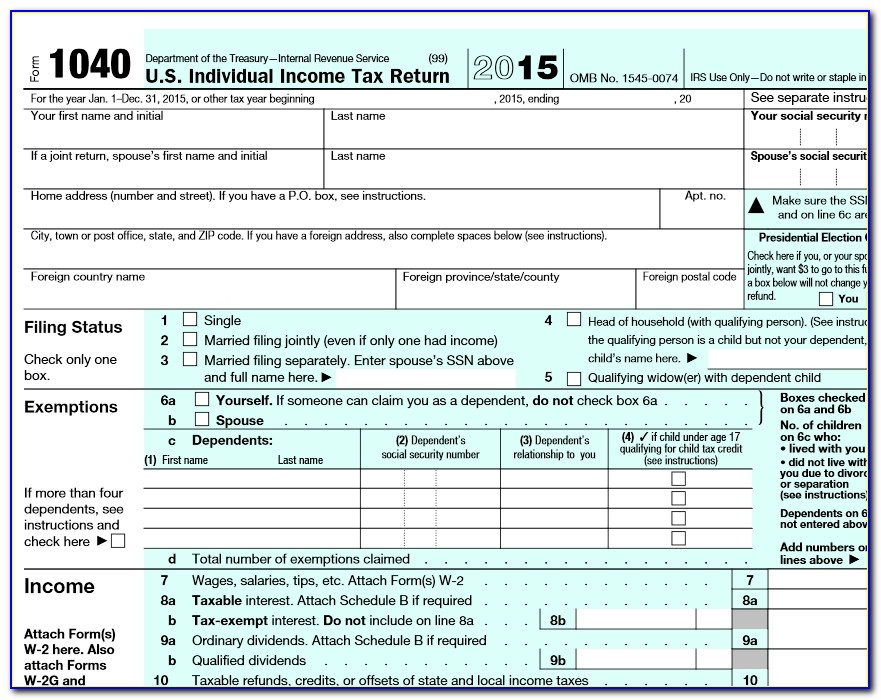

Your ITR will be processed by the IT department once it is verified. Once ITR-V will reach the CPC Bangalore, you will receive an email confirmation of the same. Send the envelope to the following address within 120 days from the date of filing of ITR: Centralized Processing Centre, Income Tax Department, Bengaluru 560100.No need to submit any supporting documents or annexures along with ITR-V Enclose your ITR-V in a white A4 size envelope and send the envelope either through speed post or ordinary post.For Original and Revised Returns ITR-V, do not print them back to back. Do not write anything on the back of the paper.Barcode and numbers below barcode should be clearly visible in ITR-V Signature of a taxpayer should not be on Barcode. Photocopy of the signature will not be accepted. Do not print any watermarks on printed ITR-V The use of a dot matrix printer should be avoided.

Please use the InkJet/ Laser Printer to print the ITR-V. Make sure that the printed copy is readable. You can call 1-86 to order forms to be mailed.Explore Steps to send ITR V to Income Tax Department, CPC Bangalore.Over 100 libraries across the state have ordered supplies of personal income tax forms to make available to the public, or See the CONTACT US link at the top of this page. You can go to your Safari menu, preferences and then security to allow pop-ups. Mac Users: Safari may block pop ups on default. For the best user experience on this website, you should update your browser ( Internet Explorer, Chrome, Firefox or Safari ). Allow the pop-ups and double-click the form again. Note: Your browser may ask you to allow pop-ups from this website.

If you click on a folder and run a search, it will only search that folder. Click on the folders below to find forms and instructions. You May Mail a Paper Return Directions to print forms:ġ. There are three ways to file: (1) using our website, at no cost, (2) purchasing software to prepare your taxes or (3) using a tax professional to file electronically.

The Department encourages all taxpayers to file electronically it’s fast and secure. For more information see our Forms & Publicationspage or the forms and instructions provided in the Browse or Search Forms section below. Remember to sign and date your forms and mail them. Everyone who is required to file a New Mexico personal income tax return must complete and file a form PIT-1, New Mexico Personal Income Tax Return.ĭepending upon your residency status and your own personal situation, you may need other forms and schedules. Options for filing your CT State Tax Return: Download the form(s) yourself and mail them in when completed.

0 kommentar(er)

0 kommentar(er)